seattle payroll tax proposal

Seattle Mayor Bruce Harrells proposed budget for 2023-24 would see approximately 105 million in 2023 and 130 million in 2024 as the maximum amounts. Impose a new corporate payroll tax on the Citys largest businesses that will generate approximately 500 million.

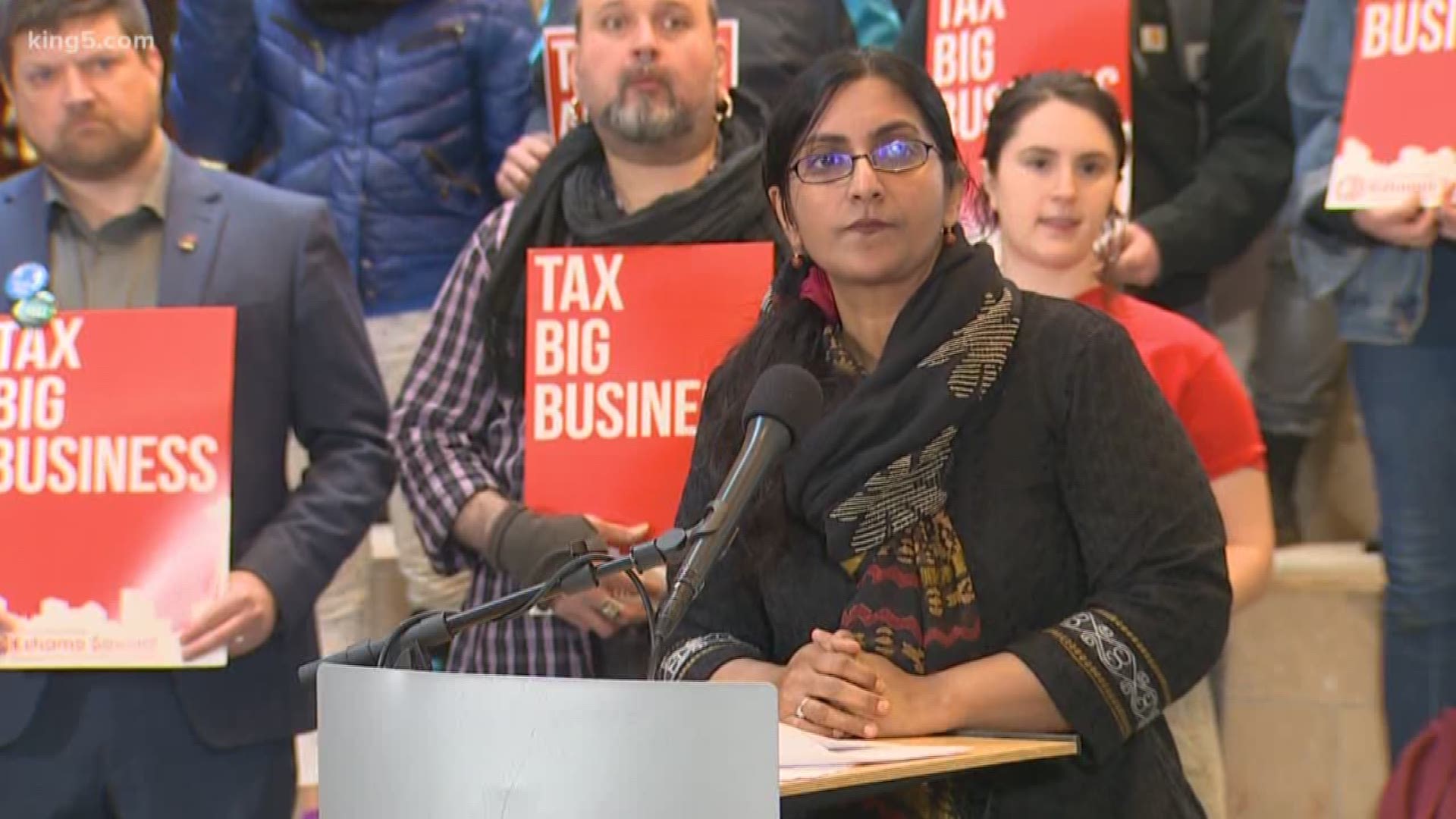

Seattle Councilmember Sawant Unveils Payroll Tax Idea While Defending Herself Against Ethics Violations King5 Com

I think this would be a starting position for any new proposal.

. Employers in the first bracket will be taxed. The council voted unanimously Monday to review legislation proposed by Councilmembers Kshama Sawant and Tammy Morales that would impose a 13 payroll tax. However businesses must use the current years compensation paid in Seattle to determine the payroll expense tax due for the year.

The JumpStart Seattle plan proposes a tax on corporations with payrolls of 7 million or more and employees with salaries of 150000 or more. Because of those differences the. The ordinance establishes a tiered system of taxation on companies with annual payroll expenses exceeding 7 million.

Excess revenue from Seattle JumpStart payroll tax may help absorb. Tax on Corporate Payroll Package. Law360 April 28 2020 833 PM EDT -- Grocery stores and banks in Washington have told the Seattle City Council they oppose a proposed city payroll tax that could raise 500.

Some City Councilmembers proposed. 83980175 PROJECTED LTIR USED. Thankfully my Council colleagues agreed to take a different path.

Journalists public officials and advocates should. The Center Square Seattle Mayor Bruce Harrell has proposed using approximately 65 million from the JumpStart payroll tax to fight climate change as part of. As you may recall I strongly critiqued Councilmember Sawants tax proposal in April.

This morning Council member Kshama Sawant unveiled her proposal for a new payroll tax in Seattle independent of and possibly on top of one already proposed for King. For example in 2021 businesses that had 7 million or. Imposing a new tax only in Seattle incentivizes employers to relocate or start up anywhere but Seattle.

It is estimated it will. While the top tax rate charged under the Seattle plan is 24 the state plan as currently written would charge businesses 05 at most. Two Seattle council members have formally introduced a proposed payroll tax on the largest companies in the city a so-called Amazon tax and presented a petition signed by.

Seattle Passes Big Business Tax On Salaries Of Top Earners After Years Of False Starts Geekwire

Kshama Sawant Wants To Tax Amazon So People Can Afford To Live In Seattle Can She Pull It Off Amazon The Guardian

Seattle S Proposed Budget Relies On Payroll Tax To Fix 140m Revenue Gap Washington Thecentersquare Com

Understanding The Mayor S Proposed 2022 Budget Part Iii Expenses

Appeals Court Upholds Seattle S Payroll Tax On High Earning Workers Following Chamber Challenge Geekwire

Mosqueda Introduces Her Own Amazon Tax Proposal

King County Judge Upholds Payroll Tax For Seattle Corporations That Pay High Salaries King5 Com

Council Connection Councilmember Mosqueda Moves Forward With Transparency And Accountability Measures For Jumpstart Seattle

Council Finally Unveils Proposed Tax On Businesses

Seattle A Step Away From Approving New Progressive Revenue Tax On Big Businesses To Help Overcome Covid 19 Budget Crisis Chs Capitol Hill Seattle

Seattle Approves New Payroll Expense Tax Grant Thornton

Seattle City Council Select Budget Committee Session Ii 10 12 22 Youtube

Here S How Seattle S Proposed Tax On Businesses To Pay For Homelessness Services Would Work Chs Capitol Hill Seattle

Opinion Tax Foundation Seattle Times Highlight Capital Gains Income Tax Advisory Vote Clarkcountytoday Com

Council Discusses Details Of Proposed Payroll Tax

Kuow Mayor Durkan Responds To Proposed Payroll Tax

Current Covid 19 Related Tax Guidance For Oregon Washington And California Kbf Cpas